The Case for Industrial: Cannabis Sector Growth

No matter what side of the issue you stand on, the facts are the facts, and data shows that the use of cannabis, both medically & recreational, is legalizing state by state faster than ever before. At the turn of the century, 63% of Americans were against the legalization of cannabis vs. 31% who were for legalization. Fast forward to 2018 and the tables have turned—34% of Americans are against legalization vs. 65% who are for it.

Even Republicans are rapidly converting to believers in the legalization of cannabis. In 2018, the Texas Republican Party amended its platform to include three separate cannabis planks, support for industrial hemp, decriminalization, and expansion of the state’s existing medical marijuana program. It’s progress.

So what does this have to do with real estate?

In states that have already passed laws legalizing cannabis, growth has occurred dramatically in Class B industrial districts where warehouses and factories are being converted into cultivation / manufacturing facilities and even retail shops. CBRE published a research study in 2017 stating that in Denver, Colorado, warehouse leases signed for use by the cannabis industry exceeded market rents by 2-4x.

Innovative Industrial Properties (NYSE: IIPR) is up 272.5% in the last 12 months. “IIPR is the pioneering REIT for medical-use cannabis industry. Founded in December 2016, we are the first publicly traded company on the NYSE to provide real estate capital to the medical-use cannabis industry.” (IIPR Website)

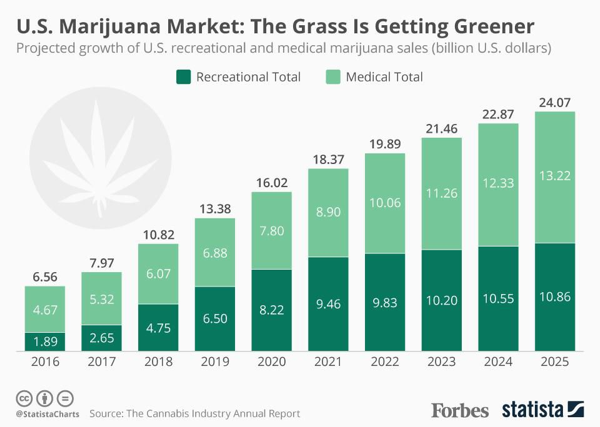

At Fort, we believe the cannabis game is still in the very early innings. In fact, we might still be on the practice field. There is a lot of reason for us to believe the tailwinds in cannabis are strong and will be around for many years and decades to come.

Please keep Fort Capital in mind as an aggressive purchaser of these assets. If you’re a broker, we’d love to tell you more about our Deal Incentive Program. Please reach out to Hunter Harrison (hharrison@fort-companies.com) for more information.

–Chris Powers

Have you signed up for our email newsletter? Click here to join the conversation.